Nobody expected the Tax Forum to be some be-all-and-end-all session where some ideas would triumph and be legislated while others would be kyboshed, never to be heard of again. It isn't the Grand Final of Tax and it's sloppy reporting to express it that way (journos might claim that they're bringing in readers by hyping it, but they'd be wrong about that too). Equally, given both the breadth and depth of experience represented there and the possibilities in a hung parliament, it is not just a "gabfest" either (another journo cliche that fails to either heighten interest or elucidate the issues).

Let's look at the last major attempt at tax reform. The idea of a GST was first raised in the Asprey Report, commissioned by the Whitlam Government in 1975, after value-added taxes had been introduced in European countries and US states for some years. It was raised again in fits and starts over the years, including in a tax summit not dissimilar to this one in 1985, and in Fightback! in 1993. It was still a live issue at the following election, when John Howard denied that he'd introduce one, and at the following one where he said he would.

There was a scare campaign around the GST when it was proposed in the 1990s, which is amazing for something covered so comprehensively. The Democrats amended it at the last minute to exempt food, education and healthcare. After it was enacted there was a high degree of adjustment to and acceptance of the new system (which was accompanied by Business Activity Statements and other compliance issues that were not adequately explained). The degree of acceptance and adjustment is something that the media at the time played a very small part in bringing about, whereas it played a very large part in hyping up the scare campaign.

Not having learned anything from any wide-ranging previous efforts, Peter van Onselen complains that GST and mining tax were left out. You've got to draw a line somewhere, but oh no - it's censorship:

The agenda for the forum deliberately omitted the GST, the mining tax and superannuation reforms. Three of the most important areas for taxation policy debate aren't important enough for this government to open them up to specific sessions.Oh, fuck off. The GST alone took a quarter century. As for superannuation, rather than the various experts coming to Canberra to get sneered at by ignorant clowns in the press gallery, the relevant minister (Bill Shorten) has been going to them - something similar is apparently happening with the mining tax.

As it is, the gamut of this event is so broad that it is likely that good ideas (such as reforms to funding of local government) will not get the chance to be fully considered. Or as van Onselen puts it:

... general sessions where they will be quickly moved on from very limited discussion. It's a joke.You can't win with Peter van Onselen, but you have to do what you can.

The Henry Report was treated like a joke way back when it was released, last year. There was a lot of facile media coverage at the time about wombats and such, then that died away. Then the Rudd government said it would implement some things and not others without any sort of debate as to why (and no hope that they might change their minds). The alternative government did not respond to the report itself or the government's reaction in any meaningful way. There it sat, another artefact of public-policy archaeology, until Rob Oakeshott and Tony Windsor insisted that the Henry Review have the follow-up it deserved.

The Forum should have been part of a wider debate, linked to issues like housing prices and the two-speed economy and the ageing society - you know, irrelevant, dry-as-dust stuff like that. In such a process all of the scare campaigns could have been tried on and fizzled out before they started clogging up Hansard.

It's easy to have sympathy for the states not keeping their end of the bargain when GST revenues started flowing. Ever since the commonwealth assumed full income taxation powers during World War II, the states have struggled to find the funds to operate the many services for which they are responsible: schools, healthcare, roads and transport. But it's time something was done. Glory-seeking politicians gravitate towards the federal arena, but it is at state level the heavy lifting of government really goes on.Explains why glory-seeking journalists will bypass a number of state capitals to fly across the continent to sneer at amateurs daring to venture considered opinions on matters in federal politics rather than cover complicated issues in healthcare, infrastructure, law-and-order or infrastructure provision.

It's a political decision, not just a tax-wonk decision, that a government that spends taxes should be responsible for raising them. It is perfectly understandable that, with so many participants and so little time, the Tax Forum concentrated on real issues it could address.

Ross Gittins snarled in agreement with van Onselen:

If you're detecting a touch of cynicism in my reaction to all this, you're not wrong. Economists, business people and professional lobbyists would happily meet in Parliament House once a month to preach to each other about the need for tax reform.We can only act on the information we're given, Ross, and personally I think someone like the Economics Editor of The Sydney Morning Herald should play a greater role than he has:

But if ever there was a country that runs a mile at the hint of tax reform, we're it. Most of the rest of the developed world introduced a GST in the 1960s and '70s, but we trembled on the brink for 25 years before taking the plunge in 2000.

The way tax reform works in Australia is that whenever governments are persuaded to introduce some major reform, the opposition automatically opposes it and starts a hugely successful scare campaign, urged on by every adversely affected interest group, the shock jocks and any other media outlets looking for cheap cheers ... And the polls say the man with the neanderthal views on tax reform will be swept into office at the first opportunity.

When it comes to tax reform, Australians are utterly lily-livered.

- Television and radio are no good for putting forward complex ideas about tax reform in Australia.

- There are foreign news outlets that do this stuff but it's hard to extrapolate foreign experiences, costs and systems to what happens in Australia.

- The Murdoch press aren't going to do it.

Instead, we get both kinds of reporting on the Tax Forum of which the Australian media is capable:

- Straight who-said-what reporting, with everything equally valid and no qualification of what was said; and

- OMFG, tax is, like, soooo boring, not at all as cool and exciting as, say, sitting through inane questions in parliamentary committees (and not realising they're inane), watching the Opposition Leader wave around a boning knife or getting bawled out by a DJ.

None of the ideas put forward at the Tax Forum were particularly new. Each one of them had been carefully thought out. Some of the proposals are actually in place in other jurisdictions - but whether or not we can see these taxes at work in the real world, the fact is there is an extensive literature about different taxes and their impacts on business investment, poverty, employment and other socio-economic factors. Journos, and their editors, have no excuse for not having done their homework and reporting/analysing the Tax Forum in a way that adds value. There are no boring topics, only boring writers - like Sid Maher:

THE Productivity Commission chairman, Gary Banks, has sounded a warning to the government against using the tax system to change community behaviour in areas such as gambling, road congestion and carbon pollution.Really? Let's see:

... Mr Banks warned that raising taxes to change behaviour had to be done in "the right way to the right extent".Sid, he didn't say not to do it - he said, be careful about the way you do it. This is basic journalism failure right there. If I thought I could do anything to avert further failure by reporting Sid Maher to some sort of disciplinary and remediation outfit, I'd do it - but there isn't, so know that if you want to know what's going on then Sid Maher can't help you.

"That is very hard," Mr Banks told the forum. He argued that much of the detail on how to change behaviour with taxes was "unresolved" and risked authorities' ability to convince the community that the taxes were worthwhile.

On carbon pricing, Mr Banks said "the complexities are unbounded" ...

George Megalogenis might, though, provided he's not in journalism-for-journalism-sake mode. Starts off with a high-minded denunciation of "the Australian political system" - all very lofty so far - then this:

As Ken Henry, former Treasury secretary and now special adviser to Julia Gillard, observed: "You could have written the script to this before coming in." Employers want a tax cut; the unions want to deny them.The Tax Forum isn't a wage negotiation George, it's a discussion about the way the government raises its money, hopefully in such a way that doesn't get too much in the way of business and inequality and other laudable goals. But, in amongst all those people talking past one another you've actually found some people at loggerheads: one person says one thing, another says something else, TAX CONFLICT CLASH SHOCK and hold the front page!

Here, however - and again toward the end of his article (why does News Ltd bury the good stuff?) - Megalogenis is dead right:

Imagine if Swan had held a tax forum last year. The mining tax would be law by now, and a budget surplus locked in for 2012-13.Anything that does come out of the Tax Forum will not be considered carefully by the media. There will be ignorant statements by people who weren't part of the process and these will be treated equally with the dry and detailed work of the tax experts - for the sake of balance.

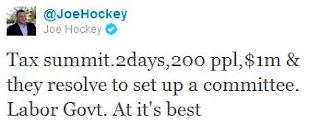

I expected better of Megalogenis. I hoped for better from the media generally. I even hoped for better from Joe Hockey:

The Tax Forum reminded me a lot of your own derp-and-CLERP approach to corporate law reform under Howard, Joe. Some issues are too big to just pooh-pooh like that, as you used to know before you got ahead of yourself. You can lose the smuggled-in apostrophes too.

We need to know how we are taxed, and what our options are for being taxed going forward. It's dull stuff and arcane, so we need journalism that can explain it to us. They won't and can't, so we turn away from them - and we're the ones with the problem for not consuming enough "proper" journalism?

Update 7 Oct: Peter Martin's coverage is excellent. Of all people, Jack the Insider does the essential element of all successful change programs - create the burning platform - and in the first half of the article. Who needs journalists?

There was a great Spooner cartoon in the Age in the late '90s labeled 'elite economics' and showing a group of swine throwing pearls from balconies to the human masses below. One could run the same cartoon today labeled 'elite journalism' except the swine would be hurling something much baser than pearls, of their own making.

ReplyDeleteDon't be too hasty about the wombats, Andrew.

ReplyDeleteRichard Glover and deep thinker, Annabel Crabb were on about Ken Henry and the hairy-nosed variety yesterday on Sydney ABC radio.

Annabel did one of her "hilarious" Valley Girl send-ups of the gathering, peppered with "sort ofs" and "like wow!s". She revels in her status as "National Treasure". I laughed so hard I nearly drove my car into a bollard. NOT.

A pretty good effort for after school at the bus-stop, ragging the dags and the "pointy heads" (Annabel's phrase), but not much chop for the national broadcaster with an audience that, on average, wouldn't mind finding out a little bit more about the Summit other than why Annabel thought it was "so, like, booooooring."

She even professed some sympathy for "poor Ken Henry", struggling to get his message out. My bullshit detector sensed no self-awareness coming from Annabel that she had considered she and her dipsy mates might be the problem, rather than the solution.

Amazing thing is she then launched into her usual breathless set-piece about how the government has sooooo much, "like, trouble" getting its message out.

And this was coming from the ABC's senior on-line reporter. Jesus wept!

Peter Martin's work has been pretty good, I have to say. There were some pretty good ideas presented well.

ReplyDeleteKymbos

I have found the reporting of the tax forum to be deplorable. I saw the opinion pieces from those advertising their own arguments put to the forum in the lead up, but there has been precious little about what actually happened during the forum. The precious little that I have been able to find simply seems to parrot the banter about the fact that tax reform is difficult (no kidding).

ReplyDeleteThis is despite the fact that going by my twitter account, there were plenty of journos watching the proceedings.

Any suggestions for good online journos/blogs to follow for those complicated issues such as taxation, planning and carbon taxation? It would be much appreciated.

ReplyDeleteNicholas Gruen at one of those specialist econo-wonk blogs proves your point about the useless reporting.

ReplyDeleteTax Forum and Chinese whispers

http://clubtroppo.com.au/2011/10/05/tax-forum-and-chinese-whispers/

Alpha and Bill, I wish I could say that you're being unfair, but I don't think so.

ReplyDeleteAnon2, see Anon1 & DMick. After I finish this I'll go through the AFR coverage and let you know.

Dan, it's the laziness that gets to me. Tax Forum coming up, do some prep.